Securing the best commercial property lease in Newcastle requires a strategic approach that starts with understanding the local market landscape. Conducting thorough research into market trends and competition can provide valuable insights, but this is just the beginning. Crafting a realistic budget that includes all potential expenses is essential for long-term success. However, the process involves more than just numbers; evaluating the location's accessibility and the property's condition are equally important. The art of negotiation comes next, where lease terms must be carefully scrutinized. Yet, one critical step remains that could greatly influence your leasing decision.

Understand the Local Market

To successfully navigate the complexities of leasing commercial property in Newcastle, gaining an in-depth understanding of the local market is essential. This knowledge not only aids in identifying prime opportunities but also guarantees competitive positioning.

Key to this understanding is an analysis of local trends, which can provide insights into market demand, popular locations, and emerging sectors. Observing these trends allows potential lessees to align their property choices with areas of growth, thereby maximising their potential return on investment.

Equally important is conducting a thorough competition analysis. By evaluating the presence and performance of similar businesses in the area, lessees can gauge market saturation and identify potential gaps. This information is critical for determining the viability of a location and adapting business strategies to gain a competitive edge.

For instance, if particular areas are witnessing a surge in specific industries, newcomers can leverage this by offering complementary services or products.

Staying informed about local market dynamics also involves monitoring infrastructure developments and policy changes that could impact property values or business operations. Newcastle's Central Business District is known for its architectural beauty and excellent transport links, making it a strategic location for businesses. By integrating these elements into the decision-making process, businesses can strategically position themselves to secure advantageous lease agreements in Newcastle's evolving commercial landscape.

Determine Your Budget

When determining your budget for a Newcastle commercial property lease, it is critical to first assess your financial capacity to guarantee sustainability over the lease term. Prioritize lease expenses by distinguishing between essential costs and discretionary spending to maintain financial stability. This strategic approach will enable you to make informed decisions and negotiate effectively with potential landlords. Additionally, consider the importance of local expertise to navigate compliance with zoning laws and understand market dynamics, ensuring your lease aligns with long-term objectives.

Assess Financial Capacity

Establishing a clear understanding of your financial capacity is an essential step in securing a commercial property lease in Newcastle. A thorough examination of your financial standing will allow you to make informed decisions, ensuring that the property chosen aligns with your fiscal capabilities.

Begin by developing detailed financial projections, which should include anticipated revenue streams, operating costs, and potential fluctuations in market conditions. This analysis will provide an all-encompassing view of your financial health and guide your leasing decisions.

Investment analysis is equally critical in this process. Evaluate the potential return on investment (ROI) for the property in question. Consider factors such as location, market trends, and long-term growth potential. A detailed investment analysis will help ascertain whether the property is a sound financial commitment and support your overall business objectives.

Additionally, consult with financial advisors or accountants who specialize in commercial real estate to gain insights into any potential financial risks or opportunities. Their expertise can offer a nuanced understanding of your financial position and assist in making strategic decisions. Understanding fiscal risks and sustainability is crucial as it can significantly impact your long-term financial planning and leasing strategies.

Prioritize Lease Expenses

Understanding your financial capacity lays the groundwork for effectively prioritizing lease expenses when determining your budget. A thorough comprehension of your financial standing is vital for negotiating lease agreements that align with your business strategy.

Effective expense management is essential to guarantee that your commercial property lease adds value rather than becoming a financial burden. Here, we outline a strategic approach to prioritizing lease expenses:

- Evaluate Fixed Costs: Begin by identifying fixed costs associated with the lease, such as rent, utilities, and insurance. These are non-negotiable and must be factored into your budget from the onset.

- Anticipate Variable Costs: Variable costs, including maintenance fees and property taxes, can fluctuate. Prepare for these contingencies by allocating a buffer in your budget to accommodate potential increases.

- Negotiate Favorable Terms: Engage with landlords to explore opportunities for negotiation within the lease agreements. This can include seeking reduced rent periods or flexible lease terms to better manage expenses.

- Review Periodically: Regularly review your lease expenses in the context of your overall financial plan. This will enable you to adjust your budget and expense management strategies as your business evolves.

Prioritizing lease expenses guarantees that your commercial property investment remains sustainable and beneficial for your business growth. As the demand for EV charging points surges, consider the potential for additional revenue streams from installing such facilities, which could offset some lease expenses.

Evaluate Location and Accessibility

A critical factor in leasing commercial property in Newcastle is the evaluation of location and accessibility. The importance of property visibility cannot be overstated. High visibility guarantees that your business captures the attention of potential customers, thereby driving foot traffic and enhancing brand recognition. Ideal locations are typically those situated in bustling areas with high pedestrian flow or along major roads where signage is easily noticed.

Furthermore, thorough assessment of transport links is essential. Proximity to public transport hubs such as bus and train stations can greatly impact both customer access and employee convenience. Properties that are well-served by public transport are often more attractive to businesses seeking to maximize accessibility for a diverse demographic.

Similarly, the availability of parking facilities should be considered, as it adds a layer of convenience for clients who prefer driving.

In evaluating location and accessibility, businesses must also consider the surrounding infrastructure and the potential for future development that could alter traffic patterns or visibility. Leveraging tools such as demographic studies and traffic analysis reports can help in making informed decisions. Newcastle supports diverse industries such as digital tech, life sciences, and creative sectors, which can significantly impact the local business environment and opportunities for growth.

Inspect Property Condition

When considering a commercial property lease in Newcastle, conducting a thorough inspection of the property's condition is imperative. This critical step guarantees that you are fully aware of the property's state before committing to a lease agreement.

A detailed property inspection can prevent unexpected costs and operational disruptions. Here are four essential aspects to focus on during the condition assessment:

- Structural Integrity: Examine the building for any visible signs of damage, such as cracks in walls, leaks, or foundation issues. This can reveal underlying problems that may require costly repairs.

- Mechanical Systems: Assess the condition of heating, ventilation, air conditioning (HVAC), plumbing, and electrical systems. Verify that they are in good working order and comply with current safety standards.

- Safety Compliance: Confirm that the property meets all fire safety, accessibility, and health regulations. Check for functioning smoke detectors, fire extinguishers, and accessible emergency exits.

- Aesthetic Condition: Evaluate the interior and exterior finishes, such as flooring, paint, and fixtures. Aesthetic issues may affect the impression your business leaves on clients and require immediate attention.

Additionally, regular inspections should be conducted to identify any asbestos presence, as managing asbestos is a legal obligation in non-domestic properties. Conducting a detailed condition assessment provides a clear understanding of potential liabilities, helping you make an informed decision about leasing the property.

Negotiate Lease Terms

When negotiating lease terms for a commercial property in Newcastle, it is essential to understand prevailing market rates to guarantee competitive pricing.

Clarifying the lease duration is equally important, as it directly impacts long-term business planning and potential flexibility needs.

Additionally, addressing maintenance responsibilities upfront can prevent future disputes and guarantee a clear understanding between the landlord and tenant.

Newcastle's prime locations such as Quayside and Cobalt Business Park offer strategic advantages for businesses, enhancing operations and accessibility.

Understand Market Rates

Understanding market rates is essential when negotiating lease terms for a commercial property in Newcastle. Conducting thorough market research can provide valuable insights into current rental trends, ensuring that you secure a fair and competitive lease.

Here are several steps to reflect on:

- Analyze Comparable Properties: Begin by examining similar properties in the vicinity to gauge the going rates. This analysis will give you a benchmark for negotiations and help prevent overpaying.

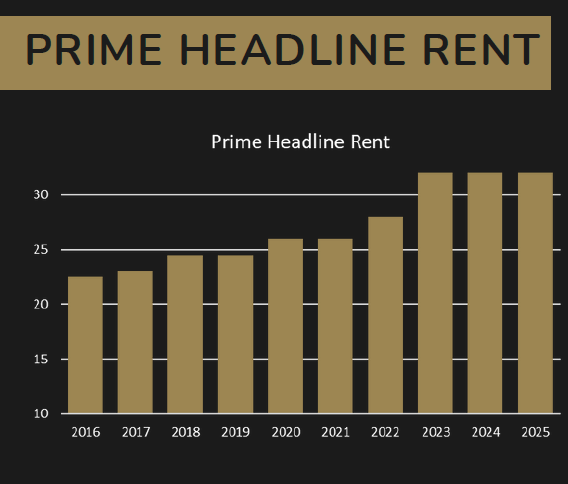

- Study Historical Data: Look into past rental trends to understand how rates have evolved over time. This approach will help you anticipate potential changes in the market, allowing you to negotiate leases with future growth in mind.

- Assess Economic Indicators: Reflect on broader economic factors affecting rental rates, such as interest rates and local economic growth. These indicators can provide context for current pricing and help forecast future market conditions.

- Consult Professionals: Engaging with local real estate agents or property consultants can offer insider knowledge and access to data that might not be readily available. Their expertise can be instrumental in understanding complex market dynamics and securing favorable lease terms.

Additionally, consider the employment rate which can impact local economic conditions and influence commercial property demands.

Clarify Lease Duration

In addition to understanding market rates, it is essential to establish a clear understanding of lease duration, as this is a key component of negotiating lease terms for commercial properties in Newcastle. The lease duration directly impacts future business planning and financial commitments. Consequently, negotiating terms that suit both parties is vital.

A lease term that is too long may lock a business into less favorable conditions, while one that is too short may not provide sufficient stability or security.

When discussing lease duration, consider the lease flexibility offered by the property owner. Lease flexibility can allow for adjustments to rental terms to accommodate business growth or unforeseen changes in the market environment. This can be achieved through break clauses, which provide the option to terminate the lease after certain periods, giving tenants a viable exit strategy without incurring significant penalties.

Renewal options should also be a focal point during negotiations. These options grant the tenant the right to extend the lease beyond the initial term under predefined conditions, often without renegotiating the entire agreement. This can be advantageous in securing long-term occupancy, providing the tenant with stability while allowing the landlord to retain a reliable tenant.

The real estate sector contributes significantly to the UK economy, with a GVA of over £110 billion, making it essential for businesses to carefully consider their property lease terms.

Address Maintenance Responsibilities

A critical aspect of negotiating commercial property leases in Newcastle is clearly defining maintenance responsibilities.

It is vital for both landlords and tenants to have a mutual understanding of maintenance obligations to guarantee smooth property upkeep throughout the lease term. This clarity helps prevent disputes and guarantees that the property remains in prime condition.

Here are four key considerations when addressing maintenance responsibilities:

- Structural Maintenance: Determine who is responsible for major repairs, such as roof leaks or foundation issues. Typically, landlords handle structural maintenance, but this should be explicitly stated in the lease.

- Routine Upkeep: Specify who will take care of regular maintenance tasks like cleaning common areas, landscaping, and waste management. Tenants often manage routine upkeep, but the lease should outline these responsibilities.

- Repairs and Replacements: Clearly define responsibilities for fixing or replacing equipment, fixtures, and other interior elements. This section should include details about response times and costs associated with repairs.

- Compliance with Regulations: Guarantee that both parties are aware of any legal requirements related to property maintenance. Responsibilities for adhering to local health and safety codes should be clearly assigned to avoid potential legal issues.

Seek Professional Advice

Maneuvering the complexities of a commercial property lease can often feel like a labyrinth, making it essential to seek professional advice. The legal implications involved in leasing a commercial property in Newcastle are multifaceted, encompassing zoning laws, lease agreements, and potential liabilities.

Engaging with a real estate attorney or a commercial property consultant provides expert insights that are vital in understanding these complexities. These professionals can help interpret lease clauses, negotiate terms, and guarantee compliance with local regulations, thereby safeguarding your business interests.

Moreover, the involvement of a seasoned expert can also serve as a strategic advantage during negotiations. They bring a wealth of knowledge about market trends, rental rates, and available properties, which can be instrumental in securing the most favorable lease terms.

Professionals can also assist in identifying potential pitfalls in a lease agreement that might otherwise go unnoticed, such as hidden costs or restrictive covenants.

In essence, seeking professional advice not only mitigates risks associated with legal implications but also empowers business owners with the confidence to make informed decisions.

Conclusion

In summation, securing a Newcastle commercial property lease necessitates a thorough grasp of market dynamics and financial planning. A meticulous evaluation of location and property condition, coupled with astute negotiation of lease terms, enhances prospects for a favorable agreement. Engaging the expertise of real estate connoisseurs guarantees a sophisticated navigation through the intricacies of lease arrangements. Ultimately, such a strategic approach facilitates an alignment of business aspirations with the nuanced realities of the commercial property landscape.