Michael Downey examines the government’s proposal to reform commercial leasing and what it could mean for landlords and office occupiers alike.

Our latest quarterly insights are now available and here is...

Michael Downey examines the government’s proposal to reform commercial leasing and what it could mean for landlords and office occupiers alike.

Introduction

A significant shift may be on the horizon for commercial lease structures in the UK. The government has proposed the introduction of legislation that would ban upward-only rent reviews in all new commercial leases. While the proposal would not apply retrospectively to existing agreements, it would directly impact new lettings and lease renewals, potentially coming into force as early as 2026.

A Tenant-Friendly Reform?

The rationale behind the proposed change is to support tenants, particularly small and independent businesses, as they navigate an increasingly volatile economic landscape. It is argued that upward only rent reviews have been historically criticised for favouring landlords by preventing rents from falling in line with challenging market conditions. Abolishing this practice is perceived to improve affordability and sustainability for high street retailers and SMEs, who have arguable been severely affected by inflationary pressures and reduced consumer spending. Nevertheless, Landlords and property investors are likely to view these proposals as counter intuitive to targeting growth in an already shrinking economy and could deter future UK investment.

Landlord Response and Market Implications

Should the reforms progress, the reaction from landlords could be one of caution. There is a risk that owners may hold back on lettings activity or become more conservative in negotiations while the proposals are debated. This could slow market momentum in the short term, particularly in submarkets that rely heavily on smaller occupiers.

Furthermore, the mechanics of lease incentives may change in the longer term. Should landlords be unable to rely on upward-only rent growth over a lease term and their security of income, the generosity of rent-free periods or fit-out contributions will likely decline, as the need to reassess their ability to recover costs over time will become a pivotal negotiating factor.

We are currently seeing a lot more landlords willing to proceed with speculative office fit outs or indeed work with the tenant to create their perfect tailored fit out and amid these proposals, there is a risk that this additional work will no longer be as attractive to landlords investing in the additional outlay of capital expenditure unless they can start to recover their costs straight away to account for the absence of a guaranteed increase in income.

A Changing Office Lease Landscape

It may be that the actual impact may be more muted than it would have been in previous decades. Reason being is that the commercial leasing market has already shifted significantly post-pandemic, with shorter lease terms and greater flexibility now seen as market standard. We have seen how five year leases with tenant break options at year three have become commonplace, and landlords have already largely adapted their approach to incentives to align with this new dynamic. So the question is, are we already halfway there with the abolishment of upward only rent reviews? It certainly may not represent such a seismic shift for modern leasing structures, but rather the continuation of an ongoing trend towards a greater balance between landlord and tenant interests.

Potential Impact

We will have to watch closely how the proposals play out as it still unclear how much these changes will benefit the intended targets, SMEs and independent businesses. Larger corporate occupiers who typically seek longer lease commitments will likely still negotiate bespoke review mechanisms. However, in an environment increasingly focused on sustainability, adaptability, and affordability, the proposal signals a clear move towards more tenant-friendly leasing standards.

Whilst the extent of the impact remains to be seen, over the coming months, we will undoubtedly see whether the markets start to react given the pace at which the reforms are intended to take effect.

Our latest quarterly insights are now available and here is...

Our latest quarterly insights are now available and here is...

Jon Tully Memorial Golf Day raises £1,300 to date.

Michael Downey examines the government’s proposal to reform commercial leasing...

Parker Knights are delighted to announce that Fusion House is...

Landlord manages to secure Aberdein Considine LLP as their latest...

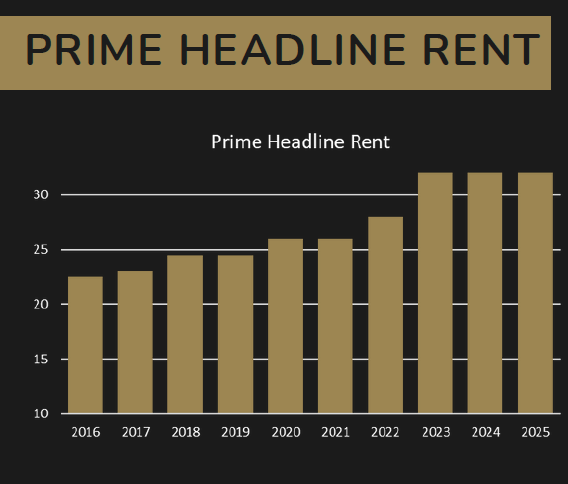

Check out the latest trends in the North East office...

In Newcastle Upon Tyne, uncover expert strategies for letting commercial...

© Copyright 2026. All rights reserved. Website design by NexusBond

Please enter your username or email address. You will receive a link to create a new password via email.