Maneuvering the commercial property market in Newcastle Upon Tyne is a nuanced endeavor, demanding a strategic approach and in-depth local knowledge. Experienced agents in the area underscore the significance of aligning investments with current infrastructure developments and demographic trends. By honing in on emerging neighborhoods and understanding zoning regulations, investors can position themselves advantageously. Establishing transparent communication and cultivating long-term relationships are also pivotal in fostering trust and collaboration. Yet, what truly sets successful agents apart in this competitive landscape? The answer lies in a less obvious, yet transformative strategy that we are about to explore.

Understanding Newcastle's Market

Steering the intricacies of Newcastle's commercial property market requires both insight and strategic acumen. As a gateway to identifying lucrative opportunities, understanding the city's economic landscape is essential. Newcastle upon Tyne, with its rich industrial heritage and evolving urban renaissance, offers an intriguing tableau for commercial property investors.

It is imperative to grasp the broader economic context, including key sectors such as technology, education, and healthcare, which greatly influence property demand and valuation.

Investment strategies in this market should be tailored to its unique characteristics. Investors must evaluate the supply and demand dynamics, considering factors such as population growth, infrastructure development, and government policies that impact commercial property. This involves a thorough analysis of market trends, historical data, and future projections to make informed decisions.

Adopting a diversified approach can mitigate risks and enhance returns, especially in a market known for its cyclical nature.

Moreover, insights into emerging opportunities in Newcastle's commercial market underscore the importance of local expertise for successful transactions. Furthermore, aligning investment strategies with Newcastle's strategic urban development plans can yield considerable advantages. Keeping abreast of local government initiatives, such as regeneration projects and transport enhancements, can provide investors with a competitive edge, ensuring they capitalize on emerging opportunities within Newcastle's dynamic commercial property landscape.

Identifying Emerging Hotspots

Identifying emerging hotspots in the commercial property market requires a keen understanding of growth trends and the impact of infrastructure development. By closely monitoring population shifts, economic indicators, and government investment in transportation and utilities, agents can pinpoint areas poised for expansion. Strategic insights into these factors enable investors to capitalize on opportunities in burgeoning locales before they reach their peak potential. The Central Business District in Newcastle, known for its architectural beauty and excellent transport links, is a prime example of an area with significant growth potential, attracting both businesses and investors alike.

Analyzing Growth Trends

Steering through the commercial real estate landscape requires a keen eye for analyzing growth trends, particularly in identifying emerging hotspots that promise substantial returns. This process begins with thorough market analysis, which involves scrutinizing economic indicators, demographic shifts, and local business developments.

Newcastle Upon Tyne, with its dynamic economy and diverse cultural landscape, presents a unique opportunity for investors to capitalize on burgeoning areas. By leveraging data analytics and expert insights, investors can pinpoint neighborhoods poised for growth, ensuring their investment strategies are both informed and forward-thinking.

In recent developments, the surge in demand for EV charging points has created new investment opportunities that savvy investors might look to harness in Newcastle's evolving market.

In evaluating these trends, it is essential to take into account factors such as population growth, employment rates, and infrastructure projects that can drive commercial demand. Emerging hotspots often exhibit increased business activity and rental growth potential, signaling a ripe environment for investment.

Additionally, understanding the competitive landscape and consumer behavior within these areas can provide deeper insight into their long-term viability.

The ability to accurately identify and invest in these hotspots hinges on staying abreast of the latest market developments and trends. By doing so, investors not only enhance their portfolio's resilience but also position themselves to reap significant benefits from Newcastle's evolving commercial property market landscape.

Infrastructure Development Impact

As investors analyze growth trends, the impact of infrastructure development emerges as a powerful catalyst in identifying emerging hotspots within the commercial real estate market.

In Newcastle Upon Tyne, strategic infrastructure upgrades are creating dynamic opportunities for property investors. Projects such as the expansion of public transportation networks and the enhancement of road systems are not merely reducing transit times but are also revealing previously underutilized areas of the city.

These improvements are pivotal in connecting commercial districts, thereby increasing their accessibility and attractiveness to businesses and consumers alike.

Economic revitalization is another significant factor driving these emerging hotspots.

Infrastructure development often acts as a precursor to broader economic activities, leading to increased business investments and job creation.

For instance, the rejuvenation of Newcastle's waterfront has not only enhanced aesthetic appeal but has also spurred retail and hospitality growth, drawing foot traffic and elevating property values.

Investors who recognize the potential of these burgeoning areas early can capitalize on the upward trajectory of property prices.

Additionally, resource management and circular economy principles are becoming increasingly relevant as they offer significant opportunities for sustainable development and long-term economic benefits.

Evaluating Property Potential

When evaluating the potential of a commercial property, a systematic approach is vital to make informed investment decisions. Property assessments form the foundation of this approach, offering insights into the asset's current condition, market value, and future prospects. A thorough assessment encompasses physical inspections, legal compliance checks, and market trend analyses. These elements collectively inform investment strategies, guiding investors on whether to proceed, negotiate, or forgo an acquisition. Understanding the location's economic and demographic factors is another significant component. Newcastle Upon Tyne, with its vibrant economy and strategic position, offers diverse opportunities for investment. Evaluating factors such as foot traffic, proximity to transport links, and nearby amenities can greatly influence a property's attractiveness. Demographic trends, such as population growth and consumer behavior, further aid in predicting future demand. Financial feasibility is also essential. This involves analyzing potential rental yields, operating costs, and capital appreciation. A clear financial picture enables investors to align property choices with their long-term investment goals. Ultimately, leveraging expert insights and data-driven analysis guarantees a thorough understanding of a property's potential, mitigating risks and enhancing the likelihood of a successful investment. The British Property Federation plays a crucial role in offering authoritative insights and guidance to both government and industry stakeholders, supporting the growth and sustainability of the real estate sector.

Negotiating Competitive Deals

Having thoroughly assessed a property's potential, the next step involves negotiating competitive deals to secure the asset under favorable terms. Effective bargaining strategies are essential and can greatly impact the overall investment success. One fundamental approach is to enter negotiations with a clear understanding of the property's market value, potential returns, and any unique attributes that may justify a premium. This information equips investors with the leverage needed to negotiate terms that reflect the property's true worth. In Newcastle, businesses benefit from excellent transport connections that enhance accessibility and add to the property's appeal. Deal structuring plays a vital role in negotiations, allowing for flexibility and creativity in crafting agreements that meet both parties' needs. This might include considerations such as phased payments, leaseback arrangements, or performance-based incentives to align interests. It's also important to identify any potential concessions that could be used as bargaining chips, such as waiving certain fees or offering extended lease terms. Negotiators should remain open yet firm, maintaining a balance between assertiveness and compromise. Employing these strategies guarantees that deals are not only competitive but also sustainable, setting the stage for long-term success.

Leveraging Local Expertise

Tapping into local expertise can greatly enhance the decision-making process in commercial property investments. In Newcastle Upon Tyne, the commercial real estate landscape is rich with opportunities that are often best understood through the lens of local partnerships. Engaging with established property agents in the area offers myriad advantages. Their extensive networks can provide exclusive access to information not readily available to outsiders, enabling investors to make well-informed decisions.

Local partnerships are invaluable for gaining community insights, which can considerably impact investment outcomes. Understanding the cultural, social, and economic nuances of Newcastle can aid investors in identifying emerging trends and potential challenges in the property market. This local knowledge allows for a more nuanced analysis of market conditions, thereby optimizing investment strategies.

Moreover, expert agents with deep community connections can facilitate introductions to key local stakeholders. This can be beneficial for maneuvering complex negotiations and fostering mutually beneficial relationships, which are essential for long-term success in commercial property ventures. Engaging with the largest business network in the North East can also provide additional resources and support for investors looking to capitalize on the region's potential.

Navigating Legal Requirements

Understanding the intricacies of zoning and planning laws, lease agreement essentials, and compliance with safety standards is essential for any commercial property transaction. Steering through these legal requirements guarantees that your property not only meets regulatory standards but also aligns with your business objectives. Commercial property agents play a pivotal role in guiding clients through these complexities, helping to mitigate legal risks and facilitate smooth transactions. It's essential to determine if permission is required for projects to ensure compliance with local regulations and prevent potential legal issues.

Zoning and Planning Laws

Maneuvering the intricate landscape of zoning and planning laws is an essential aspect of commercial real estate transactions, requiring both expertise and diligence.

In Newcastle Upon Tyne, understanding zoning regulations and obtaining the necessary planning permissions are critical steps for any prospective commercial property investor or developer. These laws dictate how land can be used and developed, influencing everything from building heights to land use types, thereby directly impacting the viability of a commercial project.

Zoning regulations in Newcastle are designed to guarantee that property developments align with the city's broader urban planning goals. Consequently, they can greatly affect project timelines and feasibility.

Engaging with knowledgeable commercial property agents can help navigate these complexities, guaranteeing compliance and reducing the risk of costly delays. Agents often liaise with local planning authorities, providing valuable insights into specific zoning requirements and potential obstacles.

Furthermore, securing planning permissions is an important step that requires thorough preparation and understanding of local regulations. This process involves submitting detailed plans and proposals to local councils, where they are reviewed against existing planning frameworks.

Successful navigation of these legal requirements not only facilitates smoother transactions but also enhances the potential for successful project outcomes.

Lease Agreement Essentials

A thorough understanding of lease agreement essentials is necessary for anyone involved in commercial property transactions. Key elements such as lease duration set the foundation for tenant and landlord expectations, dictating the length of occupancy and any associated renewal options.

Tenant responsibilities, including maintenance obligations and property modifications, need clear articulation to prevent future disputes. Security deposits are another significant aspect, providing landlords with financial assurance against potential tenant defaults or property damage.

Rent escalation clauses must be carefully negotiated to account for future market changes, ensuring both parties maintain financial viability throughout the lease term. Termination clauses are fundamental, outlining conditions under which the lease can be prematurely ended, protecting interests on both sides.

Subletting policies are also important, detailing whether tenants can lease the property to third parties, thereby influencing the property's use and occupancy dynamics.

Effective dispute resolution mechanisms are essential, offering structured pathways to address disagreements without resorting to costly litigation. In some cases, planning permission might be required for property modifications, and non-compliance could lead to enforcement notices from local authorities.

Compliance and Safety Standards

Steering through commercial lease agreements is just one aspect of property management; adherence to compliance and safety standards is equally vital. In Newcastle Upon Tyne, commercial property agents underscore the importance of ensuring that all properties meet requisite safety regulations. This not only safeguards tenant welfare but also shields landlords from potential legal repercussions.

Compliance audits, conducted periodically, offer a thorough evaluation of a property's adherence to current laws and standards, identifying any deficiencies that require attention.

Navigating these legal requirements can be intricate, given the array of regulations covering fire safety, electrical systems, and structural integrity. Agents often advise property owners to engage with specialists who can execute detailed compliance audits. Duty holders include employers and building owners in the management of asbestos, highlighting the importance of maintaining a safe environment.

These audits are essential in pinpointing areas that may pose risks, ensuring that necessary remedial actions are taken promptly. Failure to comply with safety regulations can result in hefty fines and, in severe cases, closure of the property.

Securing Financing Options

Maneuvering the complexities of securing financing options for commercial properties requires a strategic approach and a deep understanding of available resources. In Newcastle Upon Tyne, the commercial property market is vibrant, but traversing it can be challenging without the right financial backing.

A thorough financing strategy is essential, and alternative lenders play an increasingly important role in this landscape. These lenders offer flexible terms and creative solutions that traditional banks may not provide, making them a viable option for investors seeking to optimize their financial plans.

When evaluating financing options, it's important to assess diverse strategies to identify the most suitable path for your investment. Being well-versed in the current trends and financial instruments can make a meaningful difference in securing the necessary capital.

Here are some key aspects to evaluate:

- Explore Diverse Lenders: Look beyond traditional banks and assess alternative lenders who offer innovative financing solutions.

- Assess Financing Terms: Analyze the interest rates, repayment schedules, and conditions to guarantee alignment with your investment goals.

- Leverage Professional Advice: Consult with financial advisors and property agents to tailor a financing strategy that aligns with your business objectives.

Understanding and leveraging these aspects can greatly enhance your ability to secure commercial property financing effectively.

Managing Property Investments

Effectively managing property investments is essential for maximizing returns and ensuring long-term success. One critical aspect of this management involves implementing robust property maintenance strategies. Consistent upkeep not only preserves the asset's value but also enhances tenant satisfaction, thereby reducing vacancy rates.

Regular inspections, prompt repairs, and upgrades tailored to market demands are crucial components of these strategies. By maintaining a proactive approach to property care, investors can mitigate unforeseen expenditures and sustain their assets' appeal.

Equally important is the consideration of investment diversification options. Diversifying a property portfolio reduces risk and increases opportunity for steady income streams.

Investors might explore different types of commercial properties, such as office spaces, retail units, or industrial facilities, each offering unique benefits and challenges. Additionally, geographical diversification can protect against location-specific economic downturns.

Staying Ahead of Trends

Staying ahead of trends in the commercial property sector demands a keen ability to predict market shifts, an openness to embracing innovative technologies, and a readiness to adapt to demographic changes.

By accurately forecasting these shifts, agents can position themselves and their clients advantageously within the market.

Additionally, leveraging cutting-edge technologies and understanding demographic dynamics are essential for maintaining a competitive edge and ensuring long-term success.

Predicting Market Shifts

Anticipating market shifts is essential for commercial property agents aiming to maintain a competitive edge. Understanding the nuances of market dynamics allows agents to make informed decisions that can lead to successful investments and client satisfaction.

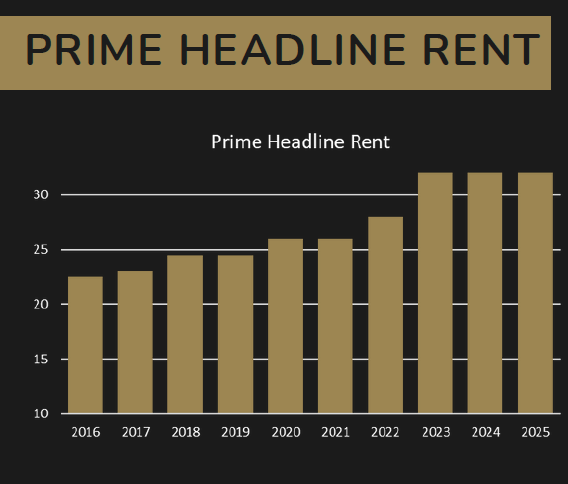

One of the primary tools in predicting these shifts is the analysis of market indicators. These indicators, such as vacancy rates and rental yields, provide insight into current trends and potential future developments within the commercial property sector.

Economic forecasts also play an important role in anticipating market shifts. By analyzing predictions on economic growth, interest rates, and inflation, agents can gauge the overall health of the economy and its impact on property demand and supply. Staying abreast of these forecasts enables agents to strategize effectively and advise clients with confidence.

To effectively predict market shifts, agents should consider the following approaches:

- Regularly review and interpret relevant market indicators to identify emerging trends in the commercial property landscape.

- Stay informed about economic forecasts to understand their potential implications on property values and investment opportunities.

- Engage with industry experts and participate in forums to gain diverse perspectives and insights on market dynamics.

Embracing Innovative Technologies

In the rapidly evolving landscape of commercial real estate, leveraging innovative technologies is essential for maintaining a competitive advantage. As the commercial property market in Newcastle Upon Tyne continues to grow, embracing smart building technologies has become vital for property agents aiming to enhance efficiency, sustainability, and tenant satisfaction.

Smart buildings, equipped with automated systems for lighting, heating, and security, offer considerable energy savings and reduce operational costs. This intelligent infrastructure not only minimizes environmental impact but also attracts eco-conscious tenants seeking modern and sustainable workspaces.

Moreover, virtual reality (VR) is revolutionizing the way commercial properties are marketed and leased. By providing immersive, 360-degree tours, VR allows potential tenants to explore properties remotely, markedly reducing the time and resources spent on physical viewings.

This technology is particularly beneficial in a globalized market, where decision-makers can evaluate properties from afar. VR also aids in visualizing unfinished spaces, enabling potential tenants to imagine the future potential of a property.

Adapting to Demographic Changes

As the demographics of urban centers like Newcastle Upon Tyne undergo significant shifts, commercial property agents must adeptly adapt to these changes to maintain relevance and success. Understanding the evolving landscape is essential, as demographic shifts bring about new consumer preferences that impact demand for commercial spaces.

Agents must stay informed about these changes to provide valuable insights and drive strategic decision-making.

One key factor is the rise of younger populations, such as millennials and Generation Z, who prioritize sustainability and technology in their consumer preferences. Commercial properties that integrate eco-friendly practices and smart technologies are increasingly attractive to these demographics.

Additionally, the aging population presents unique opportunities for developments that cater to health and wellness needs.

To effectively navigate these demographic shifts, commercial property agents should consider:

- Market Research: Conducting thorough research to understand community demographics and anticipate future trends.

- Adaptable Spaces: Designing flexible commercial spaces that can be easily reconfigured to suit changing demands.

- Community Engagement: Building strong relationships with local communities to better understand their preferences and needs.

Building Long-Term Relationships

Establishing a foundation for enduring relationships with clients is a cornerstone of success in the commercial property industry. Effective client engagement strategies are essential in nurturing these relationships, ensuring continuous interaction and communication that aligns with clients' evolving needs.

Tailoring communication approaches to individual client preferences, whether through regular updates, personalized meetings, or digital touchpoints, can greatly enhance the client experience. Such proactive engagement fosters a sense of loyalty and commitment, critical for long-term collaboration.

Trust building techniques are equally pivotal in solidifying these relationships. Transparency in dealings, from clear communication about market conditions to honest assessments of property potentials, cultivates trust. Clients appreciate when agents demonstrate integrity, consistently delivering on promises and maintaining open lines of communication.

Additionally, showcasing expertise through insightful market analyses and informed recommendations further strengthens clients' confidence in the agent's capabilities.

Moreover, investing in relationship-building initiatives beyond transactional interactions can create a more personal connection. Hosting client appreciation events, offering educational seminars, or even simple gestures like congratulatory notes on business milestones can reinforce relationships.

Ultimately, prioritizing client satisfaction and consistently exceeding expectations will lay the groundwork for sustained partnerships, driving mutual growth and success in the commercial property sector.

Conclusion

In the ever-evolving domain of Newcastle Upon Tyne's commercial property market, vigilance and adaptability are paramount. As the river of opportunity flows, those equipped with knowledge of local trends, infrastructure, and regulatory landscapes can navigate successfully. The confluence of strategic investment and robust client relationships serves as the cornerstone for enduring success. By embracing these insights, investors and agents alike can harness the dynamic nature of the market, ensuring prosperous ventures in the competitive commercial property landscape.