Newcastle’s commercial property sector is undergoing notable transformation, influenced by evolving business needs and regeneration efforts across the city. Demand for offices and retail units remains high, especially in well-connected districts and emerging suburban areas. Investors and landlords face new considerations, from sustainability standards to flexible workspace models. With rental values and occupancy rates showing resilience, the local market presents unique opportunities—and challenges—that warrant closer examination as conditions continue to shift.

Key Trends Shaping Newcastle’s Commercial Property Market

As Newcastle’s economy adapts to shifting business needs and technological advancements, several key trends are redefining its commercial property market.

Sustainability initiatives are at the forefront, with many developers and landlords prioritizing energy-efficient building designs, green certifications, and renewable energy sources. This focus reflects both regulatory pressures and increasing tenant demand for environmentally responsible spaces.

Alongside sustainability, technology integration is also shaping the sector. Smart building systems, advanced security features, and high-speed connectivity are now considered essential by occupiers seeking modern, flexible workspaces.

The adoption of remote and hybrid work models further accelerates digital upgrades.

In addition, there is growing recognition of the importance of circular economy principles in reducing material use, waste, and environmental impacts, encouraging Newcastle stakeholders to adopt more resource-efficient construction and management practices.

Together, these trends are driving a transformation in Newcastle’s commercial property landscape, encouraging stakeholders to rethink property offerings and invest in more future-proof, adaptable environments.

High-Demand Areas for Offices, Retail, and Industrial Spaces

High-demand areas for commercial property in Newcastle include both the bustling Central Business District and rapidly developing suburban zones.

Office and retail spaces remain particularly sought after in the city centre, while industrial units are increasingly popular in suburban growth hotspots.

Understanding these location trends is essential for those seeking to secure the right property to let.

Local agents with in-depth local market knowledge can provide valuable insights into emerging opportunities and current market dynamics, helping clients make informed decisions when navigating Newcastle’s diverse commercial property landscape.

Central Business District Trends

While Newcastle’s commercial landscape continues to evolve, several districts within the Central Business District (CBD) consistently attract strong interest for office, retail, and industrial spaces.

Centralization benefits play a significant role, as businesses seek proximity to major transport links, clients, and complementary services located within the CBD. This clustering effect promotes efficient collaboration and networking opportunities, making the area particularly desirable for professional service firms and technology companies.

Additionally, ongoing urban revitalization projects have enhanced the appeal of the CBD, with upgraded public spaces, improved infrastructure, and modern mixed-use developments catering to diverse commercial needs.

Retailers benefit from high foot traffic, while industrial users leverage strategic logistics access. As a result, vacancies in prime CBD locations remain low, supporting resilient rental levels.

The occupancy rate in Newcastle’s modern office complexes exceeds 85%, highlighting robust demand and underscoring the area’s growth potential for a variety of commercial ventures.

Suburban Growth Hotspots

Beyond the Central Business District, Newcastle’s suburban areas have emerged as dynamic growth hotspots for commercial property.

Demand for offices, retail spaces, and industrial units is rising steadily in suburbs such as Gosforth, Jesmond, and Kingston Park. This trend is driven in part by urban migration, as businesses and employees seek locations outside the city centre that offer improved accessibility and proximity to residential zones.

Suburban amenities—including modern transport links, retail parks, and dining options—further enhance the attractiveness of these locations for both tenants and clients.

Industrial estates on the periphery benefit from good motorway access, making them ideal for logistics and warehousing.

Collectively, these factors position Newcastle’s suburbs as strategic, high-demand alternatives to the core urban market. Small businesses in these areas can further benefit from essential business protections that help safeguard their operations and support sustainable growth.

The Impact of Flexible Workspaces on Leasing

As flexible workspaces gain traction across the UK, their presence is reshaping the commercial property leasing landscape in Newcastle.

Landlords and occupiers are increasingly aware of the demand for remote flexibility, which has spurred a rise in coworking spaces, serviced offices, and hybrid lease models. This trend reflects a broader shift, with businesses seeking workspace adaptability to accommodate evolving workforce habits and unpredictable operational needs.

Flexible lease terms, shorter commitments, and customizable office configurations are becoming standard offerings. These changes are influencing traditional landlords, prompting them to reconsider space utilization and tenant engagement strategies.

In Newcastle’s city centre, this has resulted in a more dynamic leasing environment, attracting start-ups and established firms alike who prioritize adaptability over conventional long-term leases. Many businesses are now specifically looking for shorter lease terms to reduce long-term financial commitments and maintain flexibility in a rapidly changing market.

Rental Price Movements and Yield Expectations

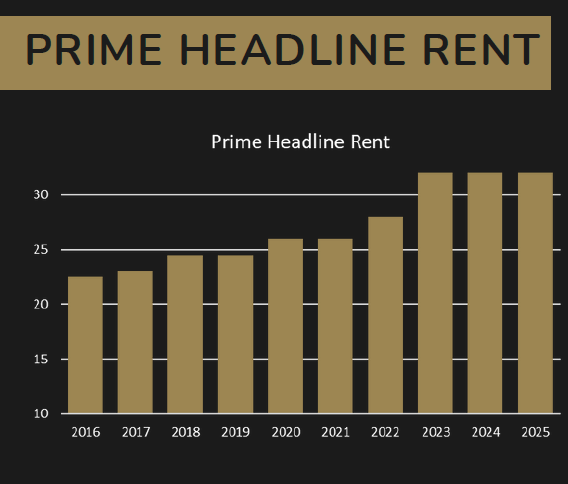

Despite recent economic headwinds, Newcastle’s commercial property market has demonstrated relative resilience in rental pricing.

Analysis reveals that rental price fluctuations have been less pronounced in Newcastle compared to other regional UK cities, with prime office and retail spaces maintaining steady rates. This stability is underpinned by sustained occupier demand and a limited pipeline of new developments, which has helped cushion the market from sharper declines observed elsewhere.

Regarding yield expectations, investors continue to find appeal in Newcastle’s yield stability, particularly in the office and industrial sectors. Yields have largely held firm, supported by long-term leases and reliable tenant profiles.

These factors position Newcastle as an attractive destination for both institutional and private investors seeking consistent returns amidst uncertain macroeconomic conditions. Additionally, new investment opportunities in the property sector—such as those driven by rising demand for EV charging points—are beginning to shape the market’s future growth potential.

Notable Developments and Regeneration Projects

While broader economic trends have influenced market sentiment, several high-profile developments and regeneration projects are actively reshaping Newcastle’s commercial property landscape.

The city’s ongoing commitment to urban renewal is evident in the revitalisation of key districts, blending modern commercial spaces with preserved historical features. Strategic cultural investments have further enhanced the city’s appeal, attracting new businesses and fostering innovation.

These transformative efforts are redefining the commercial core and setting benchmarks for sustainable development.

- The Newcastle Helix, a flagship urban renewal project, integrates cutting-edge office space with research, education, and cultural facilities.

- Quayside regeneration continues to attract both leisure and commercial ventures, leveraging significant cultural investments in public art and amenities.

- Pilgrim Street’s redevelopment introduces Grade A office accommodation, stimulating further investment and business activity in central Newcastle.

In addition, Newcastle’s regeneration initiatives increasingly incorporate decarbonising construction strategies, aligning local development with broader sustainability and carbon reduction goals.

What Landlords Need to Know About Tenant Preferences

Tenant priorities in Newcastle’s commercial property market increasingly centre on flexibility, sustainability, and connectivity.

Landlords must recognise that modern occupiers value adaptable spaces, often seeking shorter or more flexible lease terms. This demand directly influences lease negotiations, as tenants favour arrangements that can accommodate business growth or contraction without substantial penalties.

In addition, sustainability has become a core consideration, with energy-efficient buildings and green certifications greatly enhancing property appeal. High-quality tenant amenities—such as secure bicycle storage, on-site showers, and high-speed internet—play a pivotal role in attracting and retaining occupants.

Additionally, proximity to public transport and digital connectivity are now essential factors in decision-making. Landlords who align offerings with these preferences are better positioned to attract reputable tenants and achieve peak occupancy rates. Incorporating science-led training in sustainability can further boost a property’s marketability, ensuring that landlords keep pace with evolving industry standards and tenant expectations.

Tips for Securing the Best Commercial Lease in Newcastle

Maneuvering the process of securing a commercial lease in Newcastle requires careful preparation and a strategic approach. Success hinges on a thorough understanding of the local property landscape, informed by detailed market research.

Prospective tenants should evaluate prevailing rental rates, demand in targeted neighborhoods, and comparable property offerings. Effective lease negotiation can result in advantageous terms, including flexible break clauses, rent-free periods, or landlord-funded fit-outs.

Leveraging professional advice from commercial property agents or legal advisors is also critical, ensuring that every clause aligns with business objectives and mitigates potential risks.

- Conduct extensive market research to benchmark rental values and identify high-demand areas.

- Approach lease negotiation proactively, seeking favourable terms tailored to operational needs.

- Consult with commercial property experts to clarify contract terms and safeguard business interests.

When reviewing lease agreements, it’s essential to account for hidden costs such as maintenance fees, utility charges, and tenant insurance to avoid unexpected expenses and ensure accurate budgeting.

Conclusion

Steering Newcastle’s commercial property market is much like captaining a ship through changing tides. The city’s evolving trends—sustainability, flexibility, and innovation—act as guiding stars, steering investors and tenants toward promising harbours. Regeneration projects are the wind in the sails, propelling growth and stability. Those who read the currents—understanding tenant needs, prime locations, and pricing—are best positioned to anchor success. In Newcastle, opportunity awaits those prepared to set course with insight and adaptability.